Posts: 3,011

Threads: 81

Joined: Dec 2008

Reputation:

0

<!--quoteo(post=32633:date=Apr 23 2009, 03:43 PM:name=cherp)-->QUOTE (cherp @ Apr 23 2009, 03:43 PM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32280:date=Apr 22 2009, 12:52 PM:name=BT)--><div class='quotetop'>QUOTE (BT @ Apr 22 2009, 12:52 PM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32276:date=Apr 22 2009, 12:32 PM:name=Andy)--><div class='quotetop'>QUOTE (Andy @ Apr 22 2009, 12:32 PM) <{POST_SNAPBACK}><!--quotec--> Ricketts offers to share Cubs

<!--quoteo--><div class='quotetop'>QUOTE <!--quotec-->Tom Ricketts is offering private investors a stake in the Chicago Cubs as he works to finance a $900-million acquisition of the team by his family.

Crain's has learned that Mr. Ricketts — scion of the TD Ameritrade Inc. fortune — is trying to raise $100 million or more through the sale of preferred stock to wealthy individuals. Money raised from investors would reduce the amount the Ricketts family would have to borrow from banks to finance the Cubs deal.

The preferred shares would represent an ownership interest in the team but confer no voting privileges or other rights of control. Investors would be entitled to a 6.5% dividend on their shares, according to people familiar with the terms.

They also would get front-row seats at Wrigley Field, opportunities to hobnob with players and a place on an "advisory board" that would meet regularly to discuss the team's future. After 15 years, they'd get their original investment back without sharing in any appreciation in the value of the franchise over that period.

People close to the Ricketts group say Mr. Ricketts hopes to find five to 10 investors willing to put up $25 million apiece. Advisers are preparing an offering document outlining the investment terms. Mr. Ricketts has made only preliminary contacts with prospective investors, none of whom has agreed to invest. Through a spokesman, Mr. Ricketts declines to comment.

Likely prospects include the well-heeled Chicagoans who submitted bids or expressed interest in owning the Cubs when Tribune Co. put the team on the block two years ago after billionaire real estate investor Sam Zell inked a deal to take control of the struggling media company.<!--QuoteEnd--><!--QuoteEEnd-->

<!--QuoteEnd--></div><!--QuoteEEnd-->

So essentially you would get a 6.5 percent return on 25 million dollars for 15 years, then get your 25 mil back? And for that, you get front row seats and are able to hobnob? That doesn't sound like a great investment to me.

<!--QuoteEnd--></div><!--QuoteEEnd-->

How many investments are out there where you could guarantee a 6.5% rate of return and have no risk of your principle?

If you trust Ricketts creditworthyness and that this thing won't fall apart and the franchise not be able to afford to make those payments (in which case I could see it convert to an equity stake) it probably isn't the worst thing in the world for someone with an extra $25mil, and a desire to "own the Cubs" while getting a decent return on their investment to consider.

You could clearly do better, but if you look at my 401K, you can clearly do worse.

<!--QuoteEnd--></div><!--QuoteEEnd-->

Right now, of course it's a good deal. It would have been a horseshit deal in the 90's and probably part of the 2000's. It may be a horseshit deal in 2010. Right now, as bad as things are, I could get probably over 3.5 percent by just buying a CD.

If interest rates stay historically low, you are right, it would be a good investment. I don't know if you want to tie up 25 million dollars for 15 years betting on that though.

I wish that I believed in Fate. I wish I didn't sleep so late. I used to be carried in the arms of cheerleaders.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

<!--quoteo(post=32875:date=Apr 24 2009, 03:50 PM:name=BT)-->QUOTE (BT @ Apr 24 2009, 03:50 PM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32633:date=Apr 23 2009, 03:43 PM:name=cherp)--><div class='quotetop'>QUOTE (cherp @ Apr 23 2009, 03:43 PM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32280:date=Apr 22 2009, 12:52 PM:name=BT)--><div class='quotetop'>QUOTE (BT @ Apr 22 2009, 12:52 PM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32276:date=Apr 22 2009, 12:32 PM:name=Andy)--><div class='quotetop'>QUOTE (Andy @ Apr 22 2009, 12:32 PM) <{POST_SNAPBACK}><!--quotec--> Ricketts offers to share Cubs

<!--quoteo--><div class='quotetop'>QUOTE <!--quotec-->Tom Ricketts is offering private investors a stake in the Chicago Cubs as he works to finance a $900-million acquisition of the team by his family.

Crain's has learned that Mr. Ricketts — scion of the TD Ameritrade Inc. fortune — is trying to raise $100 million or more through the sale of preferred stock to wealthy individuals. Money raised from investors would reduce the amount the Ricketts family would have to borrow from banks to finance the Cubs deal.

The preferred shares would represent an ownership interest in the team but confer no voting privileges or other rights of control. Investors would be entitled to a 6.5% dividend on their shares, according to people familiar with the terms.

They also would get front-row seats at Wrigley Field, opportunities to hobnob with players and a place on an "advisory board" that would meet regularly to discuss the team's future. After 15 years, they'd get their original investment back without sharing in any appreciation in the value of the franchise over that period.

People close to the Ricketts group say Mr. Ricketts hopes to find five to 10 investors willing to put up $25 million apiece. Advisers are preparing an offering document outlining the investment terms. Mr. Ricketts has made only preliminary contacts with prospective investors, none of whom has agreed to invest. Through a spokesman, Mr. Ricketts declines to comment.

Likely prospects include the well-heeled Chicagoans who submitted bids or expressed interest in owning the Cubs when Tribune Co. put the team on the block two years ago after billionaire real estate investor Sam Zell inked a deal to take control of the struggling media company.<!--QuoteEnd--><!--QuoteEEnd-->

<!--QuoteEnd--></div><!--QuoteEEnd-->

So essentially you would get a 6.5 percent return on 25 million dollars for 15 years, then get your 25 mil back? And for that, you get front row seats and are able to hobnob? That doesn't sound like a great investment to me.

<!--QuoteEnd--></div><!--QuoteEEnd-->

How many investments are out there where you could guarantee a 6.5% rate of return and have no risk of your principle?

If you trust Ricketts creditworthyness and that this thing won't fall apart and the franchise not be able to afford to make those payments (in which case I could see it convert to an equity stake) it probably isn't the worst thing in the world for someone with an extra $25mil, and a desire to "own the Cubs" while getting a decent return on their investment to consider.

You could clearly do better, but if you look at my 401K, you can clearly do worse.

<!--QuoteEnd--></div><!--QuoteEEnd-->

Right now, of course it's a good deal. It would have been a horseshit deal in the 90's and probably part of the 2000's. It may be a horseshit deal in 2010. Right now, as bad as things are, I could get probably over 3.5 percent by just buying a CD.

If interest rates stay historically low, you are right, it would be a good investment. I don't know if you want to tie up 25 million dollars for 15 years betting on that though.

<!--QuoteEnd--></div><!--QuoteEEnd-->

There aren't many investment grade bond or other fixed income type investments, either now or historically that yield over 5%. I think it's a good deal as long as Ricketts doesn't overleverage the purchase and saddle the team with a lot of debt. So, I think it's a pretty good deal, and it isn't as if you couldn't sell the preferred shares to someone else at some point if the maturity seems a bit lengthy. If interest rates adjust, then obviously the share price would adjust as well, but it should always reflect an above average fixed income return.

Posts: 301

Threads: 3

Joined: Dec 2008

Reputation:

0

Shows how much I know. I figured if you're willing to invest $25 million over 15 years you could pretty easily manage to find something for over 6.5%.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

<!--quoteo(post=32892:date=Apr 24 2009, 04:28 PM:name=Sandberg)-->QUOTE (Sandberg @ Apr 24 2009, 04:28 PM) <{POST_SNAPBACK}><!--quotec-->Shows how much I know. I figured if you're willing to invest $25 million over 15 years you could pretty easily manage to find something for over 6.5%.<!--QuoteEnd--><!--QuoteEEnd-->

You could, but it probably would be slightly below the highest investment grade in this environment.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

FYI, the AAA avg bond yield for the past 10 years:

1999, 7.05

2000, 7.62

2001, 7.08

2002, 6.49

2003, 5.66

2004, 5.63

2005, 5.23

2006, 5.59

2007, 5.56

2008, 5.63

Posts: 3,011

Threads: 81

Joined: Dec 2008

Reputation:

0

<!--quoteo(post=32896:date=Apr 24 2009, 04:42 PM:name=rok)-->QUOTE (rok @ Apr 24 2009, 04:42 PM) <{POST_SNAPBACK}><!--quotec-->FYI, the AAA avg bond yield for the past 10 years:

1999, 7.05

2000, 7.62

2001, 7.08

2002, 6.49

2003, 5.66

2004, 5.63

2005, 5.23

2006, 5.59

2007, 5.56

2008, 5.63<!--QuoteEnd--><!--QuoteEEnd-->

And hasn't 2003 and onward been historically low as well? So aren't those years that are below 6 percent essentially the worst case scenario?

I thought I read somewhere that in normal times, people can expect 10 percent return on huge investments (which 25 million would qualify as).

I wish that I believed in Fate. I wish I didn't sleep so late. I used to be carried in the arms of cheerleaders.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

<!--quoteo(post=33038:date=Apr 25 2009, 12:47 AM:name=BT)-->QUOTE (BT @ Apr 25 2009, 12:47 AM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32896:date=Apr 24 2009, 04:42 PM:name=rok)--><div class='quotetop'>QUOTE (rok @ Apr 24 2009, 04:42 PM) <{POST_SNAPBACK}><!--quotec-->FYI, the AAA avg bond yield for the past 10 years:

1999, 7.05

2000, 7.62

2001, 7.08

2002, 6.49

2003, 5.66

2004, 5.63

2005, 5.23

2006, 5.59

2007, 5.56

2008, 5.63<!--QuoteEnd--><!--QuoteEEnd-->

And hasn't 2003 and onward been historically low as well? So aren't those years that are below 6 percent essentially the worst case scenario?

I thought I read somewhere that in normal times, people can expect 10 percent return on huge investments (which 25 million would qualify as).

<!--QuoteEnd--></div><!--QuoteEEnd-->

10%? Those would be ponzi scheme or junk bond type returns, and preferred stock is like higher grade fixed income. Normal returns on traditional equity are around 8-10%, while returns on high grade fixed income/debt are traditionally between 5-7%, before inflation. And that isn't just over the past 10 years, but using data for the past 100 or so.

But, yes 2003 and on have been very low in terms of yields on newly issued govt debt, but the above yields are on all corporate debt, both new and existing, which don't track the fluctuations in govt debt yields as closely as one might think, as other business cycle and company specific factors affect corporate rates moreso than govt rates.

Posts: 209

Threads: 2

Joined: Dec 2008

Reputation:

0

<!--quoteo(post=33038:date=Apr 25 2009, 12:47 AM:name=BT)-->QUOTE (BT @ Apr 25 2009, 12:47 AM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=32896:date=Apr 24 2009, 04:42 PM:name=rok)--><div class='quotetop'>QUOTE (rok @ Apr 24 2009, 04:42 PM) <{POST_SNAPBACK}><!--quotec-->FYI, the AAA avg bond yield for the past 10 years:

1999, 7.05

2000, 7.62

2001, 7.08

2002, 6.49

2003, 5.66

2004, 5.63

2005, 5.23

2006, 5.59

2007, 5.56

2008, 5.63<!--QuoteEnd--><!--QuoteEEnd-->

And hasn't 2003 and onward been historically low as well? So aren't those years that are below 6 percent essentially the worst case scenario?

I thought I read somewhere that in normal times, people can expect 10 percent return on huge investments (which 25 million would qualify as).

<!--QuoteEnd--></div><!--QuoteEEnd-->

10%? Not without MAJOR risk. 6.5% is not a bad return on this type of investment. And also it is somewhat of a vanity investment. While the return is decent, the "ownership of the Cubs" has to have some value to a person throwing 25mm at it. If it was just about the return, there are other things to look at for sure.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

Well, this sucks...

http://www.reuters.com/article/mergersNews...631027320090516

<!--quoteo-->QUOTE <!--quotec-->Baseball's general counsel, speaking at a sports law conference in Chicago, would not confirm the bid would not come up for a vote, but alluded to the delays.

"I thought I'd be reporting today that the Cubs' sale was going to be approved next week at our owners' meeting in New York, but negotiations there are just dragging on and taking a lot longer than anyone expected," Thomas Ostertag said. "There's really nothing more to report."

Getting the deal completed before the end of the regular season in early October is still possible, said the second source, who also was not authorized to speak on the matter.

Bankruptcy lawyers have said that once baseball owners agree to the deal, it could take a further two to four weeks for bankruptcy court approval.<!--QuoteEnd--><!--QuoteEEnd-->

Posts: 718

Threads: 34

Joined: Dec 2008

Reputation:

0

Hmm.. I guess no one told Sullivan about that...

<!--quoteo-->QUOTE <!--quotec-->Tom Ricketts lines up banks to close Cubs sale

By Paul Sullivan

Sports Business Journal reports today that Tom Ricketts has lined up three banks -- JPMorgan Chase, Citigroup and Bank of America -- to arrange the $450 million in financing needed to close the Ricketts family's $900 million acquisition of the Cubs.

The magazine said the deal could be done by this week, and that the potential closing date is in July, after the bid is sent to the court overseeing the Tribune Co. bankruptcy. The Cubs have been on the market since April of 2007. The Ricketts family still must be approved by Major League owners, though that should not be a problem.<!--QuoteEnd--><!--QuoteEEnd-->

Posts: 209

Threads: 2

Joined: Dec 2008

Reputation:

0

<!--quoteo(post=38522:date=May 18 2009, 11:12 AM:name=The Dude)-->QUOTE (The Dude @ May 18 2009, 11:12 AM) <{POST_SNAPBACK}><!--quotec-->Hmm.. I guess no one told Sullivan about that...

<!--quoteo--><div class='quotetop'>QUOTE <!--quotec-->Tom Ricketts lines up banks to close Cubs sale

By Paul Sullivan

Sports Business Journal reports today that Tom Ricketts has lined up three banks -- JPMorgan Chase, Citigroup and Bank of America -- to arrange the $450 million in financing needed to close the Ricketts family's $900 million acquisition of the Cubs.

The magazine said the deal could be done by this week, and that the potential closing date is in July, after the bid is sent to the court overseeing the Tribune Co. bankruptcy. The Cubs have been on the market since April of 2007. The Ricketts family still must be approved by Major League owners, though that should not be a problem.<!--QuoteEnd--><!--QuoteEEnd-->

<!--QuoteEnd--></div><!--QuoteEEnd-->

So banks are funding 450mm of this. And they are still selling their limited shares? How many at what price?

I wonder, at the end of the day, how much Ricketts money is going into this thing? Not that it makes a difference....just curious.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

<!--quoteo(post=38524:date=May 18 2009, 11:22 AM:name=cherp)-->QUOTE (cherp @ May 18 2009, 11:22 AM) <{POST_SNAPBACK}><!--quotec--><!--quoteo(post=38522:date=May 18 2009, 11:12 AM:name=The Dude)--><div class='quotetop'>QUOTE (The Dude @ May 18 2009, 11:12 AM) <{POST_SNAPBACK}><!--quotec-->Hmm.. I guess no one told Sullivan about that...

<!--quoteo--><div class='quotetop'>QUOTE <!--quotec-->Tom Ricketts lines up banks to close Cubs sale

By Paul Sullivan

Sports Business Journal reports today that Tom Ricketts has lined up three banks -- JPMorgan Chase, Citigroup and Bank of America -- to arrange the $450 million in financing needed to close the Ricketts family's $900 million acquisition of the Cubs.

The magazine said the deal could be done by this week, and that the potential closing date is in July, after the bid is sent to the court overseeing the Tribune Co. bankruptcy. The Cubs have been on the market since April of 2007. The Ricketts family still must be approved by Major League owners, though that should not be a problem.<!--QuoteEnd--><!--QuoteEEnd-->

<!--QuoteEnd--></div><!--QuoteEEnd-->

So banks are funding 450mm of this. And they are still selling their limited shares? How many at what price?

I wonder, at the end of the day, how much Ricketts money is going into this thing? Not that it makes a difference....just curious.

<!--QuoteEnd--></div><!--QuoteEEnd-->

The family already sold close to $400 mil in Ameritrade stock to fund around half of the deal. If they can fund the other half with debt, as that article appears to insinuate, then they may not need the four $25 mil minority investors. 50% debt isn't that bad a debt ratio (Yanks are close to 100%) in MLB terms, though I wish they could get it to around 30-40%, as the interest payments + preferred stock dividends + costs of Wrigley maintenance or renovations could constrain our spending for a very long time.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

http://www.chicagotribune.com/business/chi...0,3687209.story

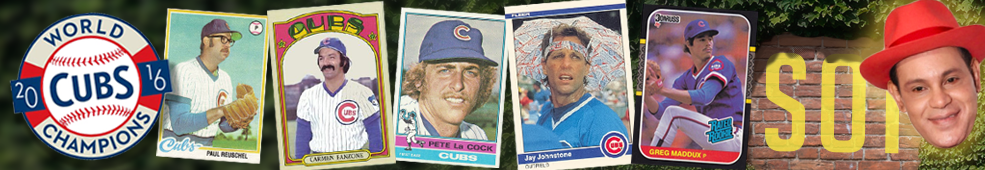

Looks like Murray [img]style_emoticons/<#EMO_DIR#>/headbang.gif[/img] , Belushi [img]style_emoticons/<#EMO_DIR#>/puke.gif[/img] , and Cusack [img]style_emoticons/<#EMO_DIR#>/explode.gif[/img] among others were approached by the Ricketts to invest $25 mil each in the Cubs as part of the preferred stock deal. 1/3 ain't bad I guess.

Posts: 11,865

Threads: 391

Joined: Oct 2008

Reputation:

0

If The Beloosh becomes part-owner of the Cubs, I might have to jump ship.

Posts: 14,143

Threads: 90

Joined: Nov 2008

Reputation:

0

<!--quoteo(post=38659:date=May 19 2009, 10:14 AM:name=Butcher)-->QUOTE (Butcher @ May 19 2009, 10:14 AM) <{POST_SNAPBACK}><!--quotec-->If The Beloosh becomes part-owner of the Cubs, I might have to jump ship.<!--QuoteEnd--><!--QuoteEEnd-->

And you know he'd be hanging around all the time hogging the camera especially now that his career has hit the skids again. He may just one day become a more annoying mascot than Woo Woo. I wouldn't jump ship, but I would probably avoid local sports media outlets aside from game time.

|